In today’s ever-evolving financial landscape, the role of quantitative finance has become increasingly vital. The convergence of sophisticated mathematical models and the vast quantities of data available in the digital age has given birth to a new era of quantitative finance, transforming the way financial professionals make decisions, manage risk, and optimise their strategies.

The Rise of Big Data

The term ‘big data’ refers to the exponential growth of data generated and stored in various digital formats. In the financial industry, this surge in data includes market data, trading volumes, historical prices, economic indicators, and more. The sheer volume, velocity, and variety of this data have redefined the financial landscape, offering both opportunities and challenges.

Data-Driven Decision Making

With the abundance of data available, financial professionals have the ability to make more informed decisions. Quantitative analysts can now harness the power of big data to gain valuable insights into market trends, investor sentiment, and trading strategies. The ability to extract actionable information from large datasets is essential in the modern financial world, as it enables more accurate predictions and improved risk management.

Risk Management and Portfolio Optimization

One of the primary applications of quantitative finance is risk management. Big data allows for the development of sophisticated risk models that can identify potential threats and vulnerabilities. These models can provide traders, asset managers, and institutions with the tools to construct portfolios that balance risk and return efficiently.

Algorithmic Trading and High-Frequency Trading

In the age of big data, algorithmic trading has become a dominant force in financial markets. Trading algorithms can process and analyse vast amounts of data in milliseconds, allowing for lightning-fast execution of trading strategies. High-frequency trading (HFT) firms use these algorithms to make thousands of trades per second. The CQF program equips individuals with the quantitative skills needed to develop and optimise trading algorithms, enabling them to compete in this fast-paced environment.

Machine Learning and Artificial Intelligence

The integration of machine learning and artificial intelligence (AI) into quantitative finance has been a game-changer. These technologies can analyse enormous datasets, detect patterns, and make predictions that were previously impossible. Machine learning models can adapt and evolve with changing market conditions, making them invaluable tools for trading, risk management, and investment strategies.

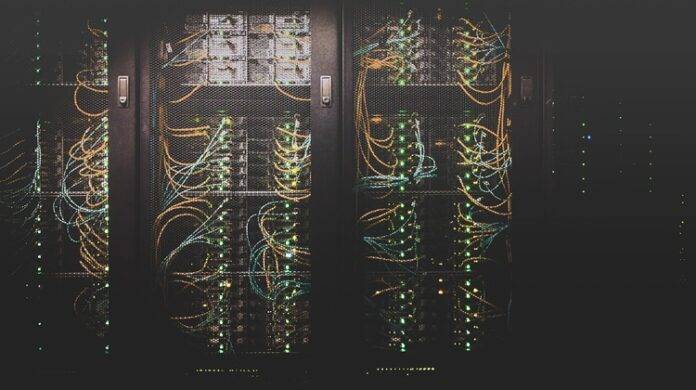

Challenges of Big Data in Quantitative Finance

While big data brings numerous benefits, it also poses challenges. The processing and storage of large datasets can be resource-intensive, and the risk of data breaches and cybersecurity threats is ever-present. Additionally, making sense of the vast amount of data available requires specialised skills.

In the age of big data, quantitative finance has never been more critical to the success of financial institutions and professionals. The ability to harness the power of data, create sophisticated models, and implement data-driven strategies is essential in today’s complex and dynamic financial markets.