Investopedia defines Fintech as a portmanteau or a bag of financial technology that describes an emerging financial services sector in the 21st century. With the expansion of technological innovation and smartphone adoption the financial industry is undergoing a transformation.

Before looking ahead to what Fintech will bring let’s first look at the emergence of it. Three factors come to mind:

- Cutting-edge ICT technologies

- Change in consumer preference on transaction methods

- Demand for alternative after the 2008 financial crisis

Fintech in short was the byproduct of events. In addition, the focus of this industry theoretically is about putting the customer first. In 2017, Fintech is expected to be the next and big growth sector. Not only will you see plenty of start-ups with new initiatives in sub-domains of credit, lending and payments, per Fintech Finance.

The above report alludes to a gradual disappearance of credit and debit cards. Their replacement will be through mobile wallet companies. You have probably heard of Google Wallet, Apple’s Passbook, Lemon Wallet, etc. They are the next frontier for making payments and consumer adoption is increasing because of the convenience factor and eliminating hassles.

The second important trend in Fintech is security. This is paramount to have since most of the sensitive financial information gets stored on a cloud server. This in turn becomes vital target for hackers. So, having a mobile security solution will be essential to protect financial transactions via these devices.

Instant gratification has been fueled by excess technology and prevalent for this generation. This means expectations are high and time is short for today´s consumers. Designing financial services that are long, arduous and bureaucratic will see customers going to a competitor that can offer quicker results.

The other driving force of change for the industry is artificial intelligence (AI). It will impact on the financial management processing and enhance banking performance. It will allow users to access more transparent and intuitive interfaces.

Disruption of the sector and industry shifts

In this era change and disruption have remained a constant. A Fintech Industry Report from 2016 by SparkLabs highlighted these following layers of disruption:

- Banking tech

- Payments

- Cyber currency

- Business finance

- Consumer finance

- Alternative cores

For example, banking tech will see analytics, data management and customer relationship management (CRM) get a makeover. In regards to payments increase usage and adoption of mobile wallet POS.

Currency as we know it may see its next evolution. Blockchain, digital wallets, cryptocurrency exchange are the few to mention and looks like they could decentralize the traditional model of finance. Bitcoin is prime example of where the exchange of money or transactions will gravitate soon.

Business finance will also see areas of peer-to-peer (P2P) business lending practices change. More flexible credit lines for business becoming less of a hassle with paperwork, and the revolutionary power of crowdfunding. Crowdfunding is a very popular financing channel that is participatory and financial institutions benefit from using it.

Alternative cores is a change from the traditional providers of health insurance, car insurance, property insurance and banks. This presents a formidable threat to current banking institutions and trust for this financial industry is low at the present time.

Investment trends in Fintech and DevOps

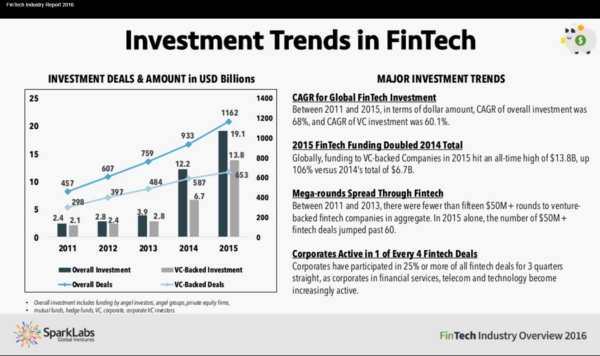

Believe it or not the investments are growing in this sector rapidly. Below is a screenshot from a Sparklabs analysis on the state of affairs and amounts:

Overview of industry trends and insights of Fortune 500 companies and startups’.

In 2014, funding from VC-backed companies attained $6.7 billion. A year later that number was $13.8 billion, which increased by 106 percent. Furthermore, in 2015 the number of $50 million fintech deals surpassed 60.

Aside from the growing trend in this sector, software development and information technology operations (DevOps) DevOps is also hitting the financial services industry. DevOps refers to a set of practices that emphasize the collaboration and communication of both software developers and information technology (IT) professionals while automating the process of software delivery, and infrastructure, conforming to Wikipedia.

As mentioned before traditional models and legacy systems in Fintech are obsolete. DevOps on the other hand, improves the collaboration between traditional development and operations of functions. In this new process you will find the tendency towards agile software development and automate testing along with deployment.

What DevOps also offers the benefits like efficient pipeline from developer desktop to production, increased efficiencies (cost savings) and earlier delivery of value (innovation).

Naturally, there is a tendency for business leaders of such enterprises to make the migration. However, outsourcing these efforts might make more sense if you are looking for new opportunities of growth. Seeking a DevOps Consulting firm is a valuable option. Another is to research a business directory for few players. Examine the differences in the services offered and costs associated with it.

Takeaways and Conclusions

The growth of the industry will continue and skyrocket. The number of startups, new technologies, payment options and birth of alternative financial services is disrupting the business.

Fintech investment has grown by 27 percent globally since 2008; the year when the housing market crashed. This growth rate even exceeds Silicon Valley that has a growth rate of 13 percent, per RainFin.

It is important financial business and industries take notice of this trend. Because the rate of growth and adoption can have an immediate impact on revenues, and profits. But overall Fintech brings with it alternatives that consumers are demanding for.